Equity investors are known to expect high returns, often double digit, in exchange for the risk they take. But over the past decade, have equity market delivered on these expectations or not?

Looking at the last 10 years, equity returns around the world range between 6% p.a. and 12% p.a.

Source: Bloomberg, March 2023

Over the past 10 years, FTSE 100 generated a total return of 6.1% p.a. of which only above 2% p.a. is price return, and the rest is from dividends reinvested into the index at the spot price.

To generate returns of this level does not necessarily require full equity risk

Structured products can help to generate similar returns with higher probability than the equity market. For example, GBP 5-year memory income autocall note (Note) with 80% coupon barrier could generate 6.1% p.a. even if the market would be down 20% and any missed coupons would be paid when the conditions are met again. In addition to this if the Note runs to maturity and the index ends above the capital protection barrier, 100% of the capital would be repaid even if the index would be down up to 35%.

Structured notes provide investors flexibility

Structured notes can offer investors flexibility to adjust the parameters and shift the risk-return profile to suit their need.

Including structured products in the investment portfolio may help to optimise overall risk/return ratio of the portfolio as they may offer not only capital protection but also stability and a level of certainty over potential future growth.

An important feature of structured products is that they enable the investors to remain exposed to equity market performance without significantly increasing the risk of their overall portfolio. This may help investors achieve their investment goals which may otherwise be unattainable. In other words, the investment goal may not be achievable with a traditional balanced portfolio while an adventurous all equity portfolio may be too risky for the client’s risk profile.

Example structured notes

Please note these examples are for illustration purposes only and not based on real market events. Structured products are capital at risk products, meaning whilst they may offer full or partial capital protection this is not guaranteed and is subject to the default risk of the issuer.

Product A – A 100% capital protected note that offers investors 130% participation in the performance of an underlying equity index (for example FTSE 100) at the end of a 5-year term.

In five years’ time, the investor would expect to get their capital back and 130% of the upside performance of the FTSE 100, subject to issuer default risk. The growth received will not include any dividend payments as structured products use dividends to increase the participation and to finance the capital protection.

Product B – An income autocall note with 5-year term that offers the investor a predefined return of 7% p.a. linked to performance of an underlying equity index (for example European stock index). The return is payable on the given observation dates if the underlying is at 80% of its initial level or above (this is known as coupon barrier). The product B also has a 65% capital protection barrier; this means investor will get all their capital back unless the market has fallen by more than 35% at maturity. In such situation the initial investment will be reduced on a one-to-one basis.

If in five years’ time, on the last observation date (assuming the autocall barrier has not been broken on any of the previous observation dates) the underlying equity index is down by 19% compared to the initial level, the investor would expect to get their capital back, as the capital protection barrier has not been broken, and 35% (7% p.a. for each year invested).

Product C – A growth autocall note with 5-year term that offers the investor a predefined return of 9% p.a. linked to performance of an underlying equity index (for example FTSE 100 index). The return is payable on the given observation dates if the underlying is at or above of its initial level (this is known as autocall barrier). The product C also has the same 65% capital protection barrier as Product B.

‘The key difference of an income autocall and capital protected note is that the returns of income autocalls are more predictable than holding the underlying index fund while the capital protected product provides safety in market declines without a significant trade-off for the upside. ‘

Benefits of including structured products in investment portfolios

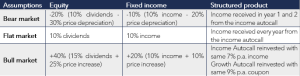

Let’s consider two portfolios, a traditional balanced portfolio of 40% equities and 60% bonds and an adventurous portfolio that has 100% equity allocation, in three different market scenarios: bearish, sideways and bullish market. The assumptions are summarised in the table below.

If we simplify and replace the assets in a traditional portfolio with structured products, we can compare how both portfolios perform.

Balanced portfolio

It is important to ensure that the investor’s portfolio is aligned to their risk appetite. Therefore, in this example of the balanced portfolio the 40% equity allocation is replaced by an income autocall, and the 60% bond allocation is replaced by a capital protected product. The autocall will provide a potential income and add equity risk to the portfolio while the capital protected note will provide safety and potential capital growth.

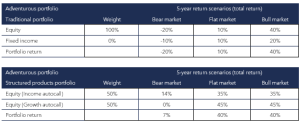

Adventurous portfolio

A traditional adventurous portfolio holds 100% in equities. This can be replaced by 50% allocation to the Income Autocall and 50% allocation to the Growth Autocall, both linked to FTSE 100. Both autocalls add equity risk to the portfolio.

Source: Causeway Securities, for illustration purposes only

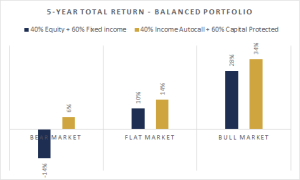

Balanced portfolio – 5-year return comparison of traditional portfolio and portfolio of structured products

Source: Causeway Securities, for illustration purposes only

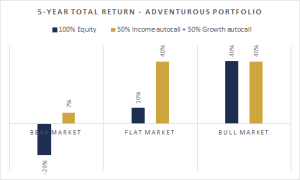

Adventurous portfolio – 5-year return comparison of traditional portfolio and portfolio of structured products

Source: Causeway Securities, for illustration purposes only

The above simplified example of replacing the traditional assets in the portfolio with structured products with similar risk profile shows that the structured products portfolio may outperform the traditional portfolio in every market scenario.

For balanced portfolio, the outperformance is most significant in the Bearish scenarios where the protection feature is bringing the most value to the portfolio and giving up some of the very high potential returns boosts the returns of the portfolio when markets are down or flat.

Adventurous portfolios build with structured products may perform as well as the 100% equity portfolios over a longer period of time in a bullish scenario, but can significantly outperform the traditional portfolio when the markets are flat or down.

While most wealth managers would not replace all traditional assets in the portfolio with structured products, the examples demonstrate that the overall portfolio performance, especially during bearish or flat markets, may be improved by including structured products in the portfolio.

‘The overall portfolio performance, especially during bearish market conditions, may be improved by including structured products the portfolio.’

Conclusion

Structured products may be a good tool to add diversification into a portfolio as they may provide a level of predictability to the portfolio returns and, due to the asymmetric payoff profiles, they can be less correlated to the traditional assets. This means that, if the markets are flat or falling, structured products may significantly reduce the downside risks and improve the risk/return ratio of portfolios.

For more information about structured products and how our products could help you to diversify your clients’ portfolios, please contact us.

Important information

This publication is intended to be Causeway Securities Limited own commentary on markets. It is not investment research and should not be construed as an offer, recommendation or solicitation to buy, sell, or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. The value of financial products can fluctuate depending on several factors, such as market conditions and the value of underlying securities. Any illustrations, forecasts or hypothetical data provided should be taken for illustrative purposes only, and not as a guarantee of future returns. Movements in exchange rates can have an adverse effect on the value, price, or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and prior to investing in any financial product or fund, you should contact your financial adviser. Furthermore, we urge investors to carefully consider whether the investment is suitable for their individual circumstances, risk tolerance, and investment objectives.

As with all forms of investment, there are risks involved with structured products, including those on our website.

It should always be understood that:

• Structured products are not suitable for everyone

• Past performance is not a reliable indicator of or guide to future performance and should not be relied upon, particularly in isolation

• The value of investment and the income from them can go down as well as up

• The value of structured products may be affected by the price of their underlying investments

• The potential returns of a structured and the repayment of money invested in a structured product depend on the financial stability of the Issuer and Counterparty

• Capital is at risk and investors could lose some or all their capital

Causeway Securities Limited is authorised and regulated by the Financial Conduct Authority. (FCA FRN 749440) in the UK and is an authorised financial services provider in terms of the Financial Advisory and Intermediary Services Act (Act No. 37 of 2002) in South Africa. Causeway Securities Limited is registered in England and Wales with company number 10102661. Registered address 2nd Floor 1 – 2 Broadgate Circle, London, England, EC2M 2QS.

In other news…

Unlocking the benefits: Why Invest in Capital Protected Structured Note?

Capital Protected St

Why does the participation rate used in structured products change?

The participation ra

PORTAL LOGIN

PORTAL LOGIN