The participation rates in structured products have experienced changes in recent months due to a combination of market conditions, interest rate fluctuations, and changes in investor sentiment. One of the key changes we have seen has been elevated market volatility due to economic uncertainties, geopolitical tensions, and fluctuating financial markets. This has led many to question how the participation rate is determined and what causes it to go up or down. In this article, we aim to explain the most common reasons for the participation rate to change.

What is a participation rate and how is it determined?

The participation rate in structured products refers to the percentage of the underlying asset’s performance that the investment will track.

The participation rate is determined by the Issuer of the structured product, usually a bank or financial institution, and is based on several factors, including the desired risk-return profile, the cost of the underlying assets or derivatives used to create the structured product.

The protected note can be decomposed into two key parts 1) a zero-coupon bond that provides the capital protection at maturity and 2) a participation in the growth of the underlying usually obtained by a call option.

The level of participation rate can be influenced by a range of factors including the level of prevailing interest rates, the creditworthiness of the Issuer, the volatility of the underlying assets, and the length of the investment term.

Interest rates

One of the main determining factors driving the protected note terms are interest rates. If interest rates move down, the Issuer must spend more on the capital protection as the zero-coupon bond becomes more expensive and have less money available to buy the participation in the growth of the underlying asset such as a fund or an index. Consequently, this means protected notes will have lower participation rates and the existing notes will become more expensive when interest rates drop (therefore an inverse relationship exists between the two).

Creditworthiness of the Issuer

The creditworthiness of the Issuer of structured products can also impact the participation rate levels. If the Issuer has a strong credit rating the zero-coupon bonds will be more expensive and again less will be available to buy participation in the growth of the underlying asset.

Volatility

Participation is usually obtained by a call option. The call options become more expensive when market volatility increases due to heightened uncertainty of future performance. Underlying assets with higher volatility can move further from their current levels, meaning the positive returns can be greater if the underlying asset’s volatility is high, while in the case of call options and 100% capital protected notes, the losses are limited to zero.

Investment term

In most cases, the longer the investment term the lower the cost of zero-coupon bonds and the higher the cost of call options. Although this relationship is not strictly linear, and the cost of call options tends to increase by less than what can be saved on the zero-coupon bond. This said it can still allow the Issuer to offer a higher participation rate because in relative terms, further away to maturity, the cost of the zero-coupon bonds decreases more compared to the increased cost of the call option, and the Issuer may be able to purchase more participation in the growth of the underlying asset.

What does this all mean in practise?

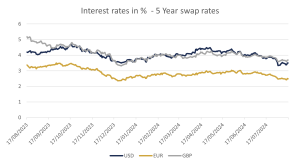

In the last few months, longer-term interest rates have started to come down as shown on the graph below.

Source: Bloomberg as at 16 August 2024.

We have also seen market volatility increase, as shown on the graph below. Increasing market volatility has a direct impact on the price of options and derivative contracts required to provide the desired participation rates. The increased cost of options coupled with the lower interest rates and funding rates from banks has started to impact the participation rates available on capital protected structured products resulting in lower participation rates.

Source: Bloomberg as at 16 August 2024.

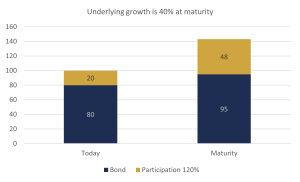

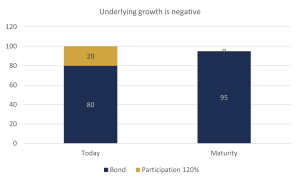

The below graphs show the value of two parts, the zero-coupon bond, and the participation, at inception and at maturity assuming two different market scenarios: one with positive 40% growth and one with negative growth.

The blue part is the zero-coupon bond that is mainly affected by the interest rates and the Issuers creditworthiness. The golden part is the amount available to buy the participation in the growth of the underlying asset. If interest rates drop and the credit risk of the Issuer reduces the cost of the zero-coupon bond will increase and less will be available for the participation and vice versa.

Source: Causeway Securities as at 12 December 2023. This graph is for illustrative purposes only.

At maturity, the zero-coupon bond will grow to the level of capital protection offered by the note (for example, 95% of the invested capital) and if there is any growth of the underlying assets this will be added on top. For example, if the note offers 120% participation and the growth of the asset was 40% over the term, the note will redeem at maturity 148%. And if the growth of the asset was negative over the term, the note will redeem at maturity 0% and the investor would only receive their capital back (subject to the Issuer credit risk and as long as the performance was within the capital protection level).

Conclusion

The level of participation is specified in the structured note’s terms and conditions at the time of issuance. This can vary significantly depending on factors, such as the level of prevailing interest rates, the creditworthiness of the Issuer, the volatility of the underlying assets, and the length of the investment term.

Investors should carefully consider the level of participation on offer and other terms that affect both the potential return and the level of risk associated with the investment before making an investment in a structured product.

If you want to know more about participation levels and Capital Protected Products offered by Causeway Securities, please contact us.

Important information

This publication is intended to be Causeway Securities Limited’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell, or trade-in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price, or income of any non-sterling-denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice, you should contact your financial adviser.

As with all forms of investment, there are risks involved with structured products, including those on our website.

It should always be understood that:

– Structured products are not suitable for everyone

– Past performance is not a reliable indicator of or guide to future performance and should not be relied upon, particularly in isolation

– The value of investments and the income from them can go down as well as up

– The value of structured products may be affected by the price of their underlying investments

– The potential returns of a structured and the repayment of money invested in a structured product depend on the financial stability of the Issuer and Counterparty

– Capital at risk and investors could lose some or all their capital

Causeway Securities Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN 749440) in the UK and is an authorised financial services provider in terms of the Financial Advisory and Intermediary Services Act (Act No. 37 of 2002) in South Africa. Causeway Securities Limited is registered in England and Wales with company number 10102661. Registered address Causeway Securities, 60 Cannon Street, London, England, EC4N 6NP.

In other news…

Unlocking the benefits: Why Invest in Capital Protected Structured Note?

Capital Protected St

Why does the participation rate used in structured products change?

The participation ra

PORTAL LOGIN

PORTAL LOGIN