Quarterly averaging is a financial technique used in structured products to smooth out the performance of an underlying asset, reduce market risk, and provide more stable returns. This method calculates the average value of the asset at regular intervals (e.g., quarterly) and bases the investment’s return on these averaged values rather than on the value at a single point in time. This article will explain how quarterly averaging works, its benefits, and provide examples to illustrate its impact.

How does quarterly averaging work?

Investment in a structured product: An investor purchases a structured product linked to an underlying asset such as a stock index.

Averaging period: The product specifies an averaging period (e.g., every quarter) and the total duration of averaging (e.g., five years).

Calculation of averages: At the end of each averaging period, the value of the underlying asset is recorded and at maturity, these values are used to calculate the average value of the underlying asset.

Return based on averages: After the final averaging period, the product pays out a return based on the average values calculated over all the quarters.

Benefits of averaging

Reduces market risk: Market risk refers to the risk that the value of an investment will decline due to changes in the market. By spreading the investment over multiple periods, averaging minimises the impact of short-term volatility.

Provides stable returns: Averaging can provide a more stable return than directly investing in the underlying asset. The performance of the underlying asset can be volatile creating large swings in the value of the investment. Averaging smooths out fluctuations in asset value, resulting in more predictable returns.

Increases the participation: The average value of the underlying asset can be less volatile than the index itself. The lower the implied volatility, the lower the cost of participation meaning the structured product is likely to be able to provide a higher participation rate on the positive performance of the underlying asset.

Enhances capital protection: Most structured products have a built-in capital protection feature that limits the investor’s losses in the event of a market downturn. Averaging can enhance this protection by reducing the impact of short-term drops in asset value.

Examples of quarterly averaging

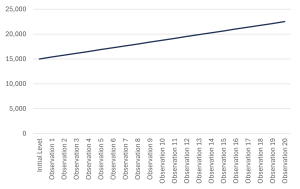

Example 1: The value of an underlying asset increases steadily

Consider a structured product linked to an underlying asset, an Index, with quarterly averaging over five years. The following table shows hypothetical observations at the end of each quarter:

| Observation point | Underlying Asset Value |

| Initial | 15000 |

| Q1 | 15375 |

| Q2 | 15750 |

| Q3 | 16125 |

| Q4 | 16500 |

| … | … |

| Q20 | 22500 |

Hypothetical performance graph

In this scenario, the value of the underlying asset increases steadily. Quarterly averaging will calculate the average of these values over time, resulting in a more stable performance metric.

Source: Causeway Securities hypothetical example for illustration purposes only.

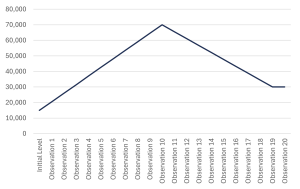

Example 2: Volatile underlying asset with a drop in value at maturity

Suppose the underlying asset experiences an increase but subsequently falls at the end of the investment period:

| Observation | Underlying Asset Value |

| Initial | 15000 |

| Q1 | 20500 |

| Q2 | 26000 |

| Q3 | 31500 |

| Q4 | 37000 |

| … | … |

| Q20 | 30000 |

Hypothetical performance graph

Here, the underlying asset increases in the initial quarters but eventually retraces and falls. The quarterly averaging method will help smooth out the fluctuations, reducing the impact of the later drops and reflecting a greater payoff than a participation note without averaging.

Source: Causeway Securities hypothetical example for illustration purposes only.

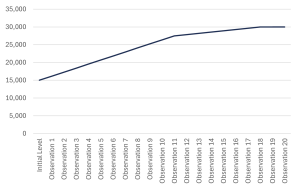

Example 3: The underlying asset with Final Quarter Fluctuations

Consider an underlying asset that fluctuates widely but ends the period at the same value it started:

| Observation | The Underlying Asset Value |

| Initial | 15000 |

| Q1 | 16125 |

| Q2 | 17250 |

| Q3 | 18375 |

| Q4 | 19500 |

| … | … |

| Q20 | 30000 |

Hypothetical performance graph

Even though the underlying asset fluctuates, quarterly averaging calculates a steady average, providing a more stable and less volatile return for the investor.

Source: Causeway Securities hypothetical example for illustration purposes only.

Conclusion

Quarterly averaging is a powerful tool used in structured products to manage market risk, provide stable returns, provide a better participation rate on the positive performance of the underlying asset and enhance capital protection. By understanding how this technique works and its benefits, investors can make more informed decisions and better navigate the complexities of financial markets.

If you want to know more about Averaging and Structured Products offered by Causeway Securities, please contact us.

Important information

This publication is intended to be Causeway Securities Limited’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell, or trade-in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price, or income of any non-sterling-denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice, you should contact your financial adviser.

As with all forms of investment, there are risks involved with structured products, including those on our website.

It should always be understood that:

– Structured products are not suitable for everyone

– Past performance is not a reliable indicator of or guide to future performance and should not be relied upon, particularly in isolation

– The value of investments and the income from them can go down as well as up

– The value of structured products may be affected by the price of their underlying investments

– The potential returns of a structured and the repayment of money invested in a structured product depend on the financial stability of the Issuer and Counterparty

– Capital is at risk and investors could lose some or all their capital

Causeway Securities Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN 749440) in the UK and is an authorised financial services provider in terms of the Financial Advisory and Intermediary Services Act (Act No. 37 of 2002) in South Africa. Causeway Securities Limited is registered in England and Wales with company number 10102661. Registered address: Causeway Securities, 60 Cannon Street, London, England, EC4N 6NP.

.

In other news…

Why does the participation rate used in structured products change?

The participation ra

Understanding averaging: How does averaging work and why is it used in some structured products?

Quarterly averaging

PORTAL LOGIN

PORTAL LOGIN