Capital Protected Structured Notes have emerged as an option that has captured the attention of both seasoned investors and newcomers. Offering a unique blend of capital protection and potential returns, these products have gained popularity for their ability to balance risk and reward. In this article, we will delve into the reasons why investing in Capital Protected Structured Notes could be a prudent choice for those seeking a well-rounded investment strategy.

What are Capital Protected Structured Notes?

Before we dive into the benefits of investing in Capital Protected Structured Notes, let’s briefly recap what they are. A Capital Protected Structured Note is a financial instrument designed to provide investors with exposure to the growth opportunities of various asset classes, such as stocks or equity market indices while offering a level of downside protection.

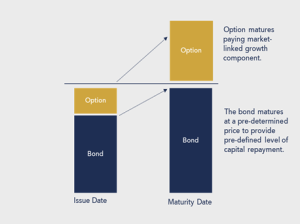

These products are typically created by financial institutions and involve a combination of a bond component (providing capital protection) and an option which offers participation in the growth of the Underlying Asset.

Source: Causeway Securities, for illustrative purposes only

What are the benefits of investing in a Capital Protected Note? Why would someone be interested in investing in a Capital Protected Note?

At times of uncertainty or long market rallies, some investors may feel the need to preserve their existing wealth and look for investments that offer a level of capital protection and opportunities for growth.

The key benefit of Capital Protected Structured Notes lies in their ability to safeguard some or all the invested capital at Maturity. This protection acts as a safety net, ensuring that even if the value of the Underlying asset declines, the initial investment remains intact. However, this does not mean that there are no risks at all as the clients are still exposed to the credit risk of the issuing entity. This means that such products only provide a full return of capital if the issuing entity does not default. In the event of this happening an Investor could lose some or all of their investment as well as any of the returns to which they may otherwise have been entitled.

The other benefits are:

Diversification: These products can provide exposure to a diverse range of assets allowing investors to spread risk across different sectors, industries, or geographic regions, potentially enhancing the overall stability of their portfolio.

Customisation: Capital Protected Structured Notes can be tailored to meet specific investor needs, such as risk tolerance and investment horizon. This customization can include choosing the Underlying assets, the level of capital protection, and the potential return profile. All this provides investors with a degree of control over their investment strategy.

Access to riskier assets for higher returns: For example, holding equities outright in the portfolio might be too risky for certain investors, but a Capital Protected Note reduces the risk while offering similar growth potential as the Underlying Asset.

Structured Risk-Reward Ratio: Capital Protected Structured Notes are designed with predetermined risk-reward profiles, allowing investors to assess potential outcomes before making an investment decision. This transparency can be especially appealing for those seeking a balanced approach to risk and return.

When would you suggest that an adviser considers this for their clients?

This type of investment is appropriate for investors in the accumulation stage of their financial planning journey who want exposure to market gains without risking their entire investment. These products usually offer participation in the selected Underlying Asset, for example, 100% of the performance of the S&P 500 Index. In other cases, the participation can be increased to, for example, 150% by reducing the return potential. This means that at Maturity if the S&P 500 is up 25% the investor would receive a boosted return of 37.5%.

The participation rate offered by Capital Protected Notes depends on a lot of market parameters with interest rate being one of the most important ones. This is why the participation rate can change from one issue to another.

These notes offer protection but also leveraged returns; sounds too good to be true?

These types of investments allow investors to access the markets with a different risk-return profile than the traditional route via funds. With this kind of investment, investors can give up some of the very high return potential and the potential dividends in exchange for capital protection and a defined return profile.

How is the Underlying selected?

The Underlying can be a single asset or a basket of assets. Which asset is selected depends on the investment objectives and desired risk profile, but most Capital Protected Notes use equity investments as an Underlying.

Expected long-term returns for equity investments can vary based on a range of factors, including economic conditions, market performance, geopolitical events, and more. Historically, equities have provided higher returns compared to other asset classes over the long term, but these returns can fluctuate significantly over various times and regions. It is important to note that past performance is not necessarily indicative of future results.

While past performance is not a guarantee of future performance the long-term average annual returns for equities in the past were:

Global Equities: Historically, global equities have yielded an average annual return of around 7% to 10% over the long-term considering various market cycles, including periods of high growth and periods of economic downturn.

Regional Equities:

-United States: U.S. equities have provided an average annual return of around 7% to 9% over the long term.

-Europe: European equities have historically yielded an average annual return of approximately 6% to 8% over the long term.

-Asia: Equities in Asian markets, such as Japan and emerging economies, have seen average annual returns of around 8% to 10% over the long term.

-Developed Markets: Equities in other developed markets have typically generated returns similar to the global average, ranging from 7% to 10%.

Source: Bloomberg as at 10 August 2023.

Conclusion

In an investment landscape marked by volatility and uncertainty, Capital Protected Structured Notes offer a compelling solution for those who seek to strike a balance between capital preservation and potential returns. These products provide a unique combination of features, including capital protection, diversification, customization, and access to various asset classes. By understanding the benefits and carefully evaluating their risk-reward profiles, investors can incorporate Capital Protected Structured Notes into their portfolios to achieve a more well-rounded and resilient investment strategy.

As with any investment decision, thorough research, consultation with financial professionals, and alignment with one’s financial goals are essential for making informed choices. For more information on Capital Protected Structured Notes and how Causeway Securities products can help you, contact us.

Important information

This publication is intended to be Causeway Securities Limited own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell, or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price, or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice, you should contact your financial adviser.

As with all forms of investment, there are risks involved with structured products, including those on our website.

It should always be understood that:

-Structured products are not suitable for everyone

-Past performance is not a reliable indicator of or guide to future performance and should not be relied upon, particularly in isolation

-The value of investment and the income from them can go down as well as up

-The value of structured products may be affected by the price of their underlying investments

-The potential returns of a structured and the repayment of money invested in a structured product depend on the financial stability of the Issuer and Counterparty

-Capital at risk and investors could lose some or all their capital

Causeway Securities Limited is authorised and regulated by the Financial Conduct Authority. (FCA FRN 749440). Causeway Securities Limited is registered in England and Wales with company number 10102661. Registered address 60 Cannon Street, London, England, EC4N 6NP.

PORTAL LOGIN

PORTAL LOGIN