Since the beginning of the year, it has been a rocky road for equity markets. The markets have been declining around the world due to inflationary concerns, rising interest rates and geopolitical problems. The Central banks have started to curtail the easy monetary policy by increasing rates whilst global economic growth optimism continues to hit all-time lows. This has seen investors starting to pull money from riskier assets and cash levels have risen to their highest levels in more than a decade.

As equity indices have lost up to 30% since the start of the year, the prices to enter the market are starting to look more attractive again with some industry experts such as CreditSights, the independent financial research company, suggesting stocks may be nearing a bottom as credit spreads have stabilised and are moving around less. However, due to higher volatility and continued uncertainty more and more investors continue to wait, and are overweight cash and underweight equity.

New opportunities

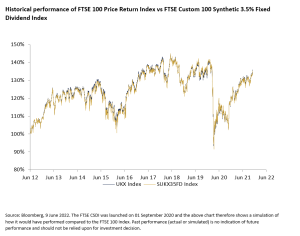

For structured products this new higher interest rate environment has created opportunities and enables us to provide investors access to equity markets via 100% Capital Protected Notes. These are packaged investment vehicles issued by a bank that use interest rates and dividends to provide capital protection and additional exposure in the price increase of equity indices.

Capital Protected Notes can be an addition to the portfolio of more cautious investors worth considering. For example, investors could potentially receive 120% to 140% exposure in the rise of a global equities while protecting 100% of their invested capital at maturity, subject to the issuer not defaulting on their obligations. This kind of investment can provide investors the best of both worlds, all or some of their money back if equities do not perform or high participation in rising equity markets.

How do Capital Protected Notes work?

Capital preservation is important and sometimes simple diversification does not do the trick. This can be especially relevant for people who need access to their investments and are nervous about market volatility.

To learn how Capital Protected Notes work, watch our animation video below.

If you want to know more about products offered by Causeway Securities, visit our website and sign up to our weekly newsletter.

Important Information

This publication is intended to be Causeway Securities Limited own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell, or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice, you should contact your financial adviser.

Causeway Securities Limited is authorised and regulated by the Financial Conduct Authority. (FCA FRN 749440). Causeway Securities Limited is registered in England and Wales with company number 10102661. Registered address 2nd Floor 1 – 2 Broadgate Circle, London, England, EC2M 2QS.

PORTAL LOGIN

PORTAL LOGIN