One of the key considerations for investors is whether they anticipate an asset to increase or decrease in value. There are three ways the investor can approach this:

• The investor can anticipate an increase in the value of an asset and look to benefit from a rise. This is known as a long position.

• The investor can anticipate a decrease in the value of an asset and look to benefit from a fall. This is known as a short position.

• The investor can anticipate that the value of an asset may remain volatile but move sideways over the short to medium term. This is known as a range-bound position.

Executing a range-bound position can be complex for the end investor; however, ‘range accrual’ type of structured notes can provide investors with ease of access to this type of investment.

The returns paid by a Range Accrual Note are determined by observing the price of an underlying asset (an ‘Underlying’) on multiple observation dates over a given period. Depending on the product chosen, the return can either be accumulated and paid at Maturity or distributed as income over time.

How do range accrual notes work?

Let’s look at a few hypothetical examples.

Accumulation Range Accrual Note, with weekly observations

Key parameters are set below:

| Underlying: | FTSE 100 Index |

| Term: | 6 years |

| Accrual Rate: | 70% |

| Accrual observation frequency: | Weekly |

| Capital Protection Barrier: | 70% (European barrier) |

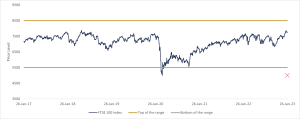

| Accrual Range: | Index level of 5500 to 8500 points |

| Credit Exposure: | An A-rated issuer |

| Product terms are entirely hypothetical and are used as an example and may vary depending upon prevailing market conditions. | |

The Note pays an accrued return linked to the performance of the FTSE 100 Index (the Underlying). The Accrual Rate of 70% is used to determine the final return paid by the Note at the end of its term. This accrual rate (70%) is multiplied by the total number of the weeks that the FTSE 100 is observed within the stated accrual range divided by the total number of weeks in the investment period. The range is set between 5500 and 8500 points.

Return = (Accrual rate) x (Number of weeks within the range / Total number of weeks)

For example, if the Underlying stays in the range the whole time, the note pays 70% return at Maturity. If the Underlying is in the range only half of the weeks, the return will be 35%.

Capital redemption in our example is also linked to the Underlying. If the FTSE 100 is down by less than 30% from the initial start level (the strike level), the investor receives their capital in full, along with any return accrued. However, if the FTSE 100 is down by more than 30%, the investor will see their capital reduced by on 1 to 1 basis along with the underlying from the initial level.

Source: Bloomberg, 27 January 2023

An Income Range Accrual Note, with annual Observation Dates.

Key parameters are set below:

| Underlying: | FTSE 100 Index |

| Term: | 6 years |

| Income Range: | 10% p.a. |

| Accrual observation frequency: | Annual |

| Capital Protection Barrier: | 70% (European barrier) |

| Accrual Range: | Index level of 5500 to 8500 points |

| Credit Exposure: | An A-rated issuer |

| Product terms are entirely hypothetical and are used as an example and may vary depending upon prevailing market conditions. | |

The Note pays an income linked to the performance of the FTSE 100 Index (the Underlying). The Income Rate of 10% is paid on each annual Observation Date if the value of the Underlying on the relevant Observation Date is within the Accrual Range of 80% – 120% of the Initial Value of the Underlying. For example, if the Initial Value was 5000, the investor would be paid the return if the value of the Underlying on the Observation Date is between 4000 and 6000 points.

Capital redemption in our example is also linked to the Underlying. If the FTSE 100 is down by less than 30% from the initial start level (the strike level), the investor receives their capital in full, along with any return accrued. However, if the FTSE 100 is down by more than 30%, the investor will see their capital reduced by on 1 to 1 basis along with the underlying from the initial level.

Conclusion

Range accruals are an excellent way to create an investment position for the investor who believes the market will be moving sideways over the investment horizon. In the volatile and high-rate environment, these products offer an excellent value proposition as we are able to achieve relatively wider ranges with high potential returns.

If you want to know more about Range Accrual Notes and how Causeway Securities could help you, please contact us.

Important information

This publication is intended to be Causeway Securities Limited’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell, or trade-in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price, or income of any non-sterling-denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice, you should contact your financial adviser.

As with all forms of investment, there are risks involved with structured products, including those on our website.

It should always be understood that:

– Structured products are not suitable for everyone

– Past performance is not a reliable indicator of or guide to future performance and should not be relied upon, particularly in isolation

– The value of investments and the income from them can go down as well as up

– The value of structured products may be affected by the price of their underlying investments

– The potential returns of a structured and the repayment of money invested in a structured product depend on the financial stability of the Issuer and Counterparty

– Capital at risk and investors could lose some or all their capital

Causeway Securities Limited is authorized and regulated by the Financial Conduct Authority (FCA FRN 749440) in the UK and in South Africa Causeway Securities Limited is an authorised financial services provider in terms of the Financial Advisory and Intermediary Services Act (Act No. 37 of 2002). Causeway Securities Limited is registered in England and Wales with company number 10102661. Registered address 2nd Floor 1 – 2 Broadgate Circle, London, England, EC2M 2QS.

PORTAL LOGIN

PORTAL LOGIN